Last updated on March 1, 2013

Together they are giving a picture that Russia is really beginning to go all in for nuclear. Of course Russia has always been a pioneer in the nuclear field, but despite that they “only” have 33 reactors running producing less than 18% of electricity.

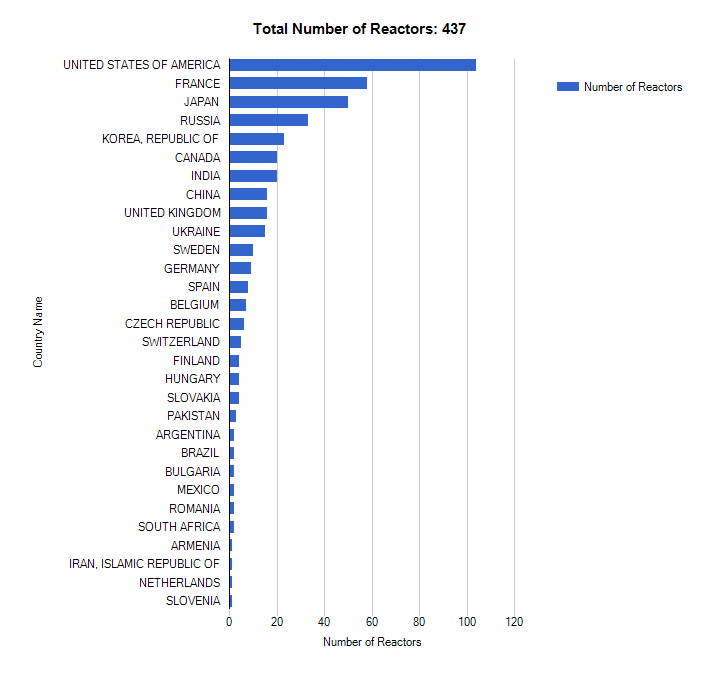

Taken from the IAEA PRIS database

Russia greatly wants to expand the share of nuclear in its energy production and it is not as (mentally) locked up in light water technology as the rest of the nuclear world. There is quite a bit of logic in that of course, going from 18% nuclear to 50% nuclear means a lot more gas will be freed up for export to other countries.

From the first article we can read:

Rosatom’s long-term strategy up to 2050 involves moving to inherently safe nuclear plants using fast reactors with a closed fuel cycle and MOX fuel. The country’s federal target program envisages nuclear providing 45-50% at that time, with the share rising to 70-80% by the end of the century.

and

The head of Rosatom, Sergei Kiriyenko, told the meeting that plans foresee the figure for research and development reaching RUB42 billion ($1.3 billion) in 2020. This is about ten times its value in 2007 when the country began consolidating its nuclear activities within Rosatom.

The second article outlines plans to build the lead cooled BREST reactor with a goal of operation in 2020

BREST refers to bystry reaktor so svintsovym teplonositelem, Russian for ‘fast reactor with lead coolant’. Its core would measure about 2.3 metres in diameter by 1.1 metres in height and contain 16 tonnes of fuel. The unit would be refuelled every year with each fuel element spending five years in total within the core. Lead coolant temperature would be around 540°C, giving a high efficiency of 43% – primary heat production of 700 MWt yielding electrical power of 300 MWe. The operational lifespan of the unit could be 60 years. The design is expected to be completed by NIKIET in 2014 for construction between 2016 and 2020.

And the third reactor outlines plans for another fast reactor, the smaller lead-bismuth cooled SVBR reactor.

The plan is to complete the design development and put on line a 100 MWe demonstration plant by the end of 2017, with total investment of RUR16 billion ($585 million). The site is to be the Research Institute of Atomic Reactors at Dimitrovgrad – Russia’s largest nuclear research centre.

Russia is also still going ahead with its sodium cooled fast reactor program, the BN series of reactors, arguably the most successful fast reactor program in the world so far based on operating experience. The BN-600 reactor has been operating safely for over 30 years with fairly high availability factor. A few years ago Russia also secured a sale of two BN-800 reactors to China and they are building their own BN-800 reactor and planning for larger models.

It is quite amazing that three large nuclear development programs seems to be thriving at the same time. Lets see which of them will be the big winner. BREST and BN targets the exact same market segment with large 1GW+ reactors while the SVBR program seems focused on small modular reactors. One can only hope that the plans materializes, big talk about big projects is not uncommon for Russia (how many times haven’t we heard about Russian plans to go to the moon or mars?). But this time around it seems like the talk has solid funding behind it. It is welcome development at a time when the western world and its regulatory system is completely stuck with light water reactors (with the exception of the though of building a GE-PRISM in the UK).

“Activists, medical practitioners and politicians who have demanded moratoriums may have various reasons for doing so, but their claims that the public and environment are at risk are fundamentally wrong. The provincial governments that have decided to ban uranium exploration have done so ignoring years of evidence-based scientific research on this industry,”

This is the kind of language we expect from regulators and it is great to see it voiced in Canada. One can only hope regulatory bodies in the rest of the world can get the guts to speak out against scaremongers in the same fashion.

The full cost of construction of the EPR is now estimated by EDF to be €2 billion ($2.6 billion) up on the July 2011 estimate of €6 billion, taking the overall estimated cost to €8 billion ($10.5 billion).

It is an embarrassment for the whole industry that AREVA seems completely unable to finish either the Finnish or French EPR for anywhere near the cost they claimed at the beginning. Its no wonder EDF wants a guaranteed price for electricity produced in its planned UK EPR’s, if I where tied to building that twice failed reactor I would also want some kind of guarantee. On the other hand the Chinese EPR project is going along splendidly, so perhaps its just another indication that Europe has forgotten how to conduct large engineering projects on time and within budget. Lets hope EDF brings in Chinese help for the EPR build in the UK just as the Americans are bringing in Chinese advisors for the AP1000 projects.

Another interesting article that popped up is this one,

Nuclear power, shale gas and the Red Queen syndrome, among other things it explains how many countries are binding up the uranium market with long term contracts and how the western world seems unaware of this. Well worth reading!

Warning: Declaration of Social_Walker_Comment::start_lvl(&$output, $depth, $args) should be compatible with Walker_Comment::start_lvl(&$output, $depth = 0, $args = Array) in /var/www/nuclearpoweryesplease.org/public_html/blog/wp-content/plugins/social/lib/social/walker/comment.php on line 18

Warning: Declaration of Social_Walker_Comment::end_lvl(&$output, $depth, $args) should be compatible with Walker_Comment::end_lvl(&$output, $depth = 0, $args = Array) in /var/www/nuclearpoweryesplease.org/public_html/blog/wp-content/plugins/social/lib/social/walker/comment.php on line 42

It is a sad testament to the engineering prowess of Europe that ‘we’ seem incapable of large engineering projects.

But what kind of short cuts are the Chinese taking (if any)?

Hopefully not any, I guess the yanks would not bring in Chinese advicers for their AP1000 projects unless Westinghouse was sure they are doing a good job?